ABOUT COMPANY New Generation Life Insurance Company

NRB Islamic Life Insurance PLC. is emerging as one of the leading full-fledged Islami Life Insurance Companies in the country in order to bring confidence among the common people of the country. We are aiming to be the premier Islami Life Insurance company in Bangladesh within the next few years. We will serve the policy holders with utmost care and provide the best solution for their needs. We will be a company with due solemnity and corporate social responsibility to the society upheld by taking financial risks. Our mission is to Islamization of the economic activities in the country for the solidarity of the Muslim Ummah and to provide financial security to our valued participants Life Takaful policies that are most beneficial for their needs.

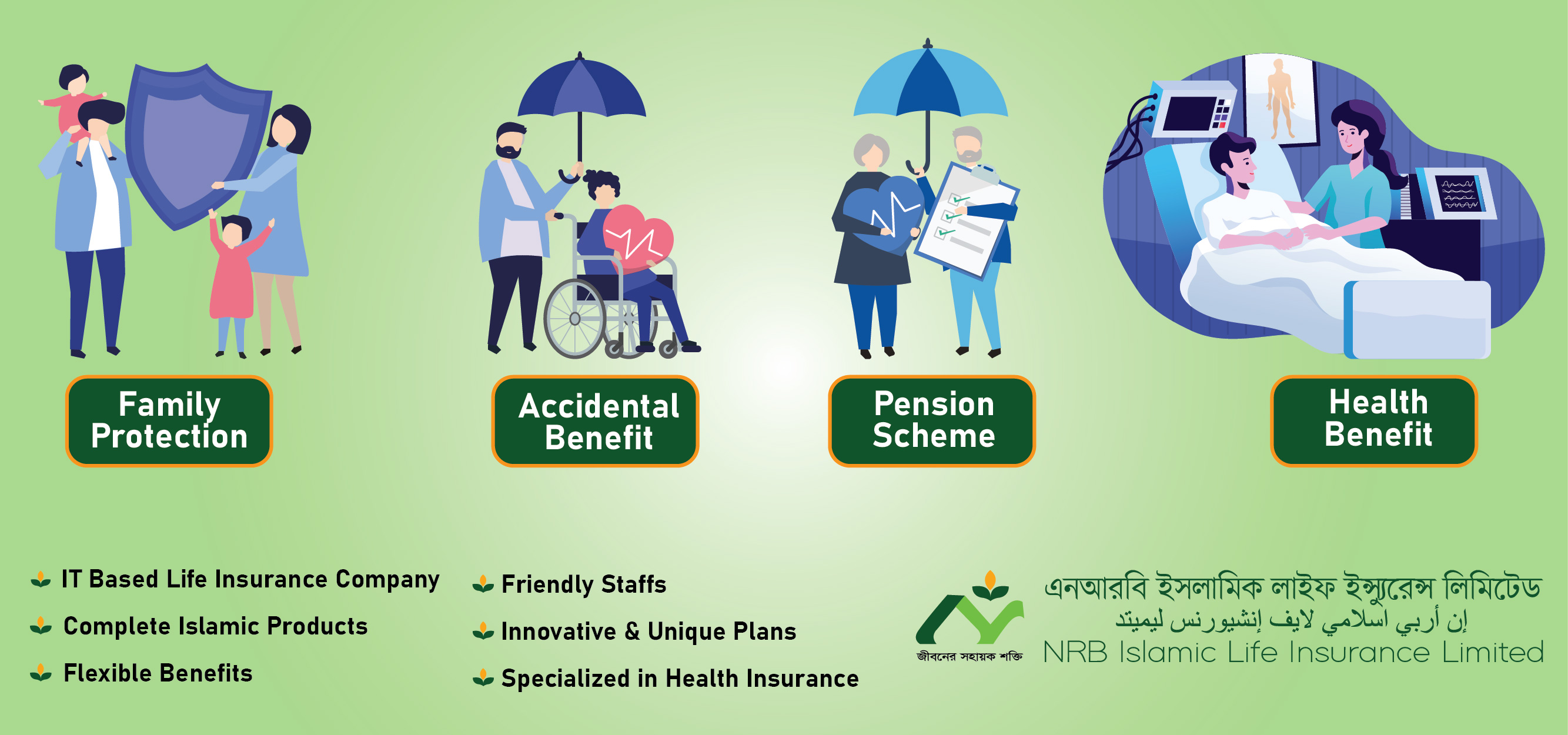

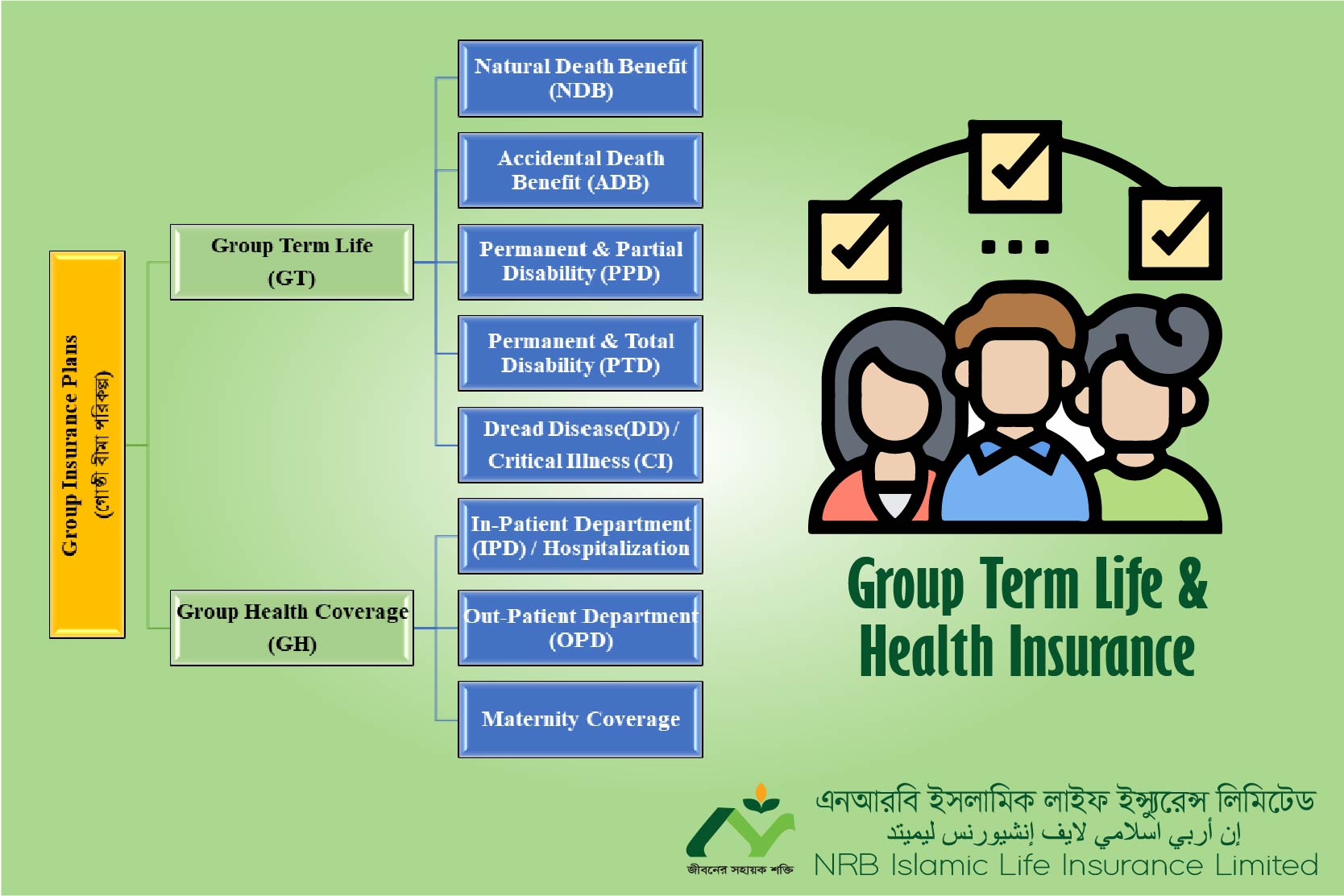

We've Got You Covered Insurance Products

Why Choose Us A Dedicated Insurance Provider

IT Based Life Insurance Company

A complete IT Based Life Insurance Company. Digitized on every steps.

Complete Islamic Products

Providing Islamic Products as a Islamic minded Company. Products are supervised by Shariah Council

Flexible Benefits

Different People has Different tastes; To compensate that we have Flexible Products with Flexible Benefits

Friendly Staff

Selling a Product is not Everything. After sales Services like Policy Servicing & Claim are Settled by our Friendly Staffs

Innovative and Unique Plans

All of our Plans are Unique & Innovative by their own Specification.

Go Paperless

Save the Trees thus Save the Planet. We're almost at the Edge of going Paperless

Besides you with Good Health or Not Why Choose NRB Islamic Life

Secure And Stable

Your investment in NRB Islamic Life insurance is totally secured. The company is starting web based premium payment and receipt collection facility to ensure transparency. The policy holders can get the information about his policy and also could pay the premium by registering at NRB Islamic Life Insurance website. Policy holders also can get email, confirmation message and also download the receipt through website.

Fastest Processing

NRB Islamic Life Insurance is the one of very few companies in Bangladesh which completes the fastest policy related process. For example, the policy holder gets confirmation message and email as soon as he/she makes premium payment. The first Premium Receipt (FPR) and the policy deed are done and ready within three working days after policy holder takes life policy. The claim process including death claim and other supplementary like PDAB , ADB, HI are completed within seven days. The policy holders get SMS notifications of his/her every transactions like proposal acceptance, premium payment, premium due reminders etc.

Online Presence and Easy Quotes

You can get most of the services of NRB Islamic Life Insurance within a click. We have the robust ERP software and App to manage and integrate the important parts of the business as well as to provide service to our valuable policy holders.

Customer Support

We have a team of expertise and Call Center executives who provide efficient services by directly connect to the policy holders via complete call center solution. The policy holders can directly call the policy service department to ensure his quarries about the premium payment and other policy related services.

We are Here to Help

Life is full of hopes and possibilities when you’re young, single and have just got a taste of financial independence. Life is suddenly looking good and exciting, right? We know, Life Insurance might be the last thing on your mind right now. But if you truly wish to achieve your life’s financial goals without any financial stress, now is the right time to invest in life insurance plans. By investing in life insurance when you are young, you not only have a protection plan for your dependents at a reasonable premium amount , you can also start building a prosperous long term future as your savings also benefit from the power of compounding.

Financial Security

When you commit to an insurance savings plan, you also commit to a disciplined saving habit. A disciplined saving habit will help you in the long term in meeting multiple financial goals, over different stages of life.

Savings and Investing

Buying life insurance when you are young has many advantages. When you are young and healthy you will enjoy the benefit of life insurance with reasonable premium amount. By starting early, you end up making substantial savings over long term.

Business Goals

Life insurance plans can help you meet multiple financial goals and provide financial protection through life cover at the same time. Based on your risk appetite, you should opt for an investment option offered in life insurance plans that suit your specific investment needs.

Paying for Education

The cost of higher education has been on the rise for many years now. An Education Protection Plan from us will allow you to secure your child’s future by planning for their educational needs.

sucessful Milestone Area The Importance Of Being Covered

We have been providing stability and reliability to our clients since 2021 to help them live their lives with confidence, to give them peace of mind, and enable them to realize their dreams for their loved ones and their legacy.